Microsoft Dynamics 365 Finance helps enterprises by enabling people to make smarter decisions quickly, transform business processes faster, and enable business growth at global scale. With the help of Dynamics 365 Finance, you can automate key processes, streamline accounting needs, and manage financial data while integrating it with other departments of your business. Its AI-driven predictive insights assist you to keep up with the ever-changing business trends. All in all, Dynamics 365 Finance allows you to boost your revenue while keeping costs in check.

Modern Finance

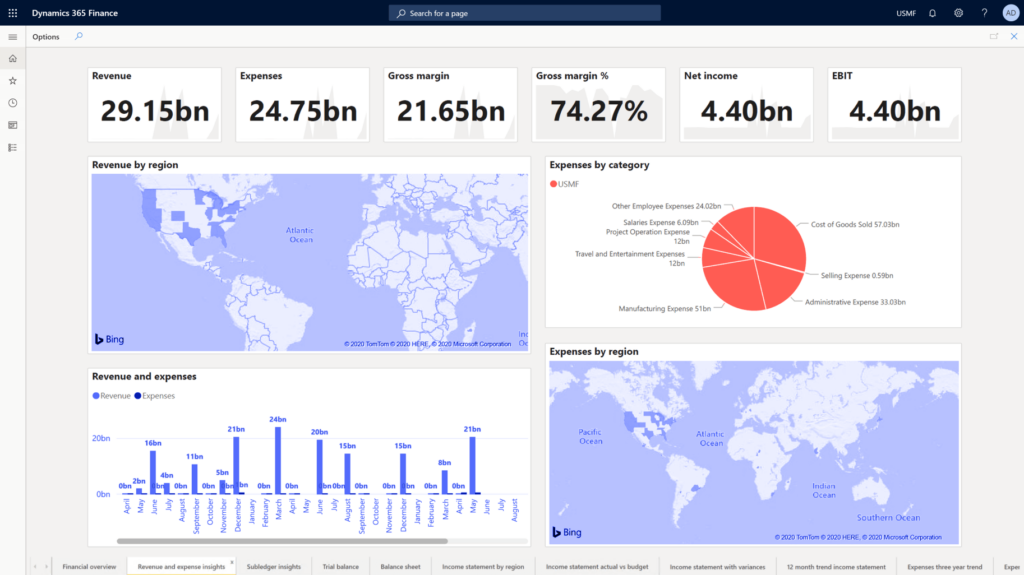

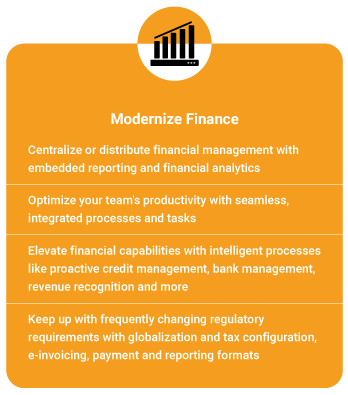

Automate and modernize your global financial operations with Dynamics 365 Monitor performance in real time, predict future outcomes, and make data-driven decisions to drive business growth.

Financial insights for decisive actions Assess the health of your business, improve financial controls, optimize cash flow, and make strategic decisions faster to drive growth by using real-time, unified global reporting, embedded analytics, and predictive insights

Unified processes across financials Enable smarter, faster actions and decisions with role-based workspaces that provide embedded Power BI interactive data visualization, giving them high-level view of key business metrics and the ability to drill-down into the transactions to monitor the health of your business and improve performance.

Optimize operations and minimize spending Minimize costs and optimize spending across business geographies with process automation, budget control, and financial planning and analysis.

General Ledger

Use General ledger to define and manage the legal entity’s financial records. The general ledger is a register of debit and c redit entries. These entries are classified using the accounts that are listed in a chart of accounts.

- Create and maintain one or more fiscal calendars that can be shared across multiple legal entities.

- Manage the status of a fiscal calendar period at the legal -entity level.

- Create and maintain currency exchange rates that can be shared across multiple legal entities.

- Ability to use different currency exchange rates for budgeting versus actuals in each legal entity.

- Create and maintain one or more charts of accounts that can be shared across multiple legal entities.

- Manage legal-entity–specific attributes for a main account.

- Manage chart-of-accounts–specific and legal-entity–specific attributes for a financial dimension value.

- Flexible account structures determine the valid combinations of main account and financial dimension values.

- Integration of the account structures with the organization hierarchies provides constraints between financial dimensions.

- Multiple account structures for each chart of accounts are supported. Support for one or more advanced rules for an account structure allows you to further constrain or enter additional financial dimensions for a specific account.

- Workflow can be set up for the review and approval of general journals, based on company policy.

- Flexible setup of accounting rules and period-end processing is supported.

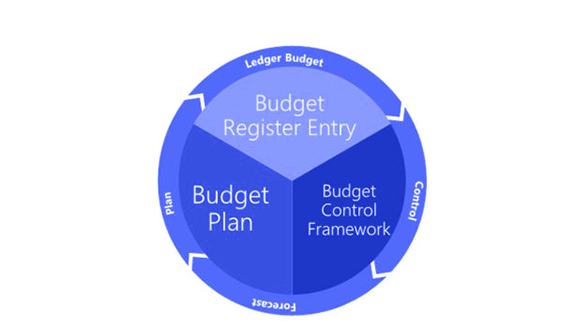

Budgeting

The resource planning cycle for a company typically consists of planning, budgeting, and forecasting activities. The processes for both long-term strategic planning and annual budget planning are supported through a budget plan document. Budget plan documents are tightly integrated with Microsoft Excel. Users can configure unlimited monetary and quantitative scenarios, and can also define a budgeting organizational hierarchy to both support top-down and bottom-up budgeting methods.

Additional planning and budgeting capabilities are available and are integrated with ledger budgets.

- Workforce budgets – Workforce budgeting includes detailed budget cost component planning for positions, compensation groups, and so on.

- Fixed assets budgets – Based on fixed asset information, you can calculate planned depreciation and record other planned transactions that are related to fixed assets.

- Project budgets – In the projects module, you can create detailed project forecasts. The projects forecasts will include details about the planned hours, expenses, fees, and items.

- Demand forecasting – Based on historical transaction data, you can estimate future inventory demand and create demand forecasts.

Accounts Payable

You can enter vendor invoices manually or receive them electronically through a data entity. After the invoices are entered or received, you can review and approve the invoices by using invoice approval journal or the Vendor invoice page. You can use invoice matching, vendor invoice policies, and workflow to automate the review process so that invoices that meet criteria are automatically approved, and the remaining invoices are flagged for review by an authorized user

- Flexible configuration options to setting up vendors

- Enforce policies

- Record Invoices

- Settlements

- Payment Terms & Payment Methods

- Payment Run with Workflows

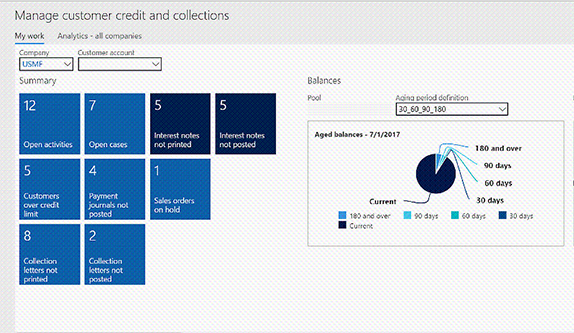

Accounts Receivable

Use Accounts receivable to track customer invoices and incoming payments. You can create customer invoices that are based on sales orders or packing slips. You can also enter free text invoices that are related to sales orders. You can receive payments by using several different payment types. These bills of exchange, cash, checks, credit cards, and electronic payments. If your organization includes legal entities, you can use centralized payments to record payments in a single legal entity on behalf of other legal entities.

- Customer Ledger

- Collection Letters & Cases

- Sales Order Invoices & Free Text Invoices

- Settlements

- Payment Terms & Payment Methods

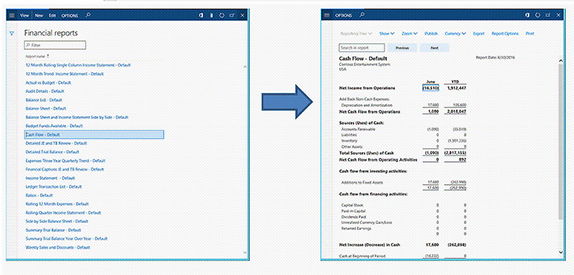

Financial reporting

- Allow financial and business professionals to create, maintain, deploy, and view financial statements

- Design reports with more flexibility using out-of-the-box Report Designer

- Manage the generation and distribution of reports using financial report collaboration capabilities

- Use interactive report viewing to change different attributes and filters and find the report data you need

Single source of intelligence

- Drive productivity from assets and resources and align employees toward strategic goals

- Take advantage of deep data and process integration across Dynamics 365, Microsoft 365, LinkedIn, and third-party applications for a centralized source of intelligent information that saves your employees time

- Collaborate across your organization and supply chain to make better and faster decisions

Elevate financial capabilities with intelligent processes

Proactive Card Management

Revenue Recognition

Budget Planning and Forcasting

Project Accounting

Cash and Bank Management

Experience Modern Finance with Dynamics 365

- Maximize financial visibility and profitability

- Financial reporting

- Single source of intelligence

- Role-based workspaces

- Integration with Office 365

- Proactive credit management

- Revenue recognition

- Budget planning and forecasting

- Project accounting

- Cash and bank management

- E-invoicing